Generally rental income is considered non-business income that is derived relatively passively. LEARNING OBJECTIVE ATXB213 MALAYSIAN TAXATION 1 2.

What Type Of Income Can Be Exempted From Income Tax In Malaysia

The IRB has published Public Ruling PR No.

. B provision as to income which is not itself subject to double taxation. Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017 Act 785 can be accessed through the Attorney Generals Chamber Official Portal at the following link. And often allow notional reductions of income.

9 rows Income under Section 4f ITA 1967. It gives the Assessing Officer the power to use their best judgement while assessing a taxpayer if adequate information is not available. Business planing and co-ordination.

Administrator Rental income is generally assessed under Section 4 d Rental Income of the Income Tax Act and is seen as income from investment. Income Tax - Earlier the author believed that we do not need a direct tax code and appropriate amendments to the Income Tax Act 1961 will do the needful. CHAPTER 4 a EMPLOYMENT INCOME - DERIVATION - ATXB213 MALAYSIAN TAXATION 1 1.

It will also give the readers an overview of what is income in revenue law. 100 Resolution of amount of any payment of income made or apportionment of income or statutory income. Section 4 income tax act malaysia Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return Pin On W 4 Form.

The new guidelines are broadly similar to the earlier guidelines and explain the penalties that will be imposed under Section 1123 of the Income Tax Act 1967 ITA Section 513 of the Petroleum Income Tax Act 1967 PITA and Section 293 of the Real Property Gains Tax Act 1976 RPGTA where a taxpayer fails to furnish a tax return within the stipulated. This page is currently under maintenance. Broadly the PR explains the taxation of.

Taxation of Income Arising from Settlements dated 13 August 2021. B Page 1 of 26 1. DEFINITION OF EMPLOYMENT Employment is defined in Sec 2 ITA 1967 employment in which the relationship of master.

Save upto Rs 46800. The new 18-page PR comprises the following paragraphs and sets out 20 examples. Federal Legislation Portal Malaysia.

10 March 2011 Issue. This R uling explains. Any appointment or office whether public or not.

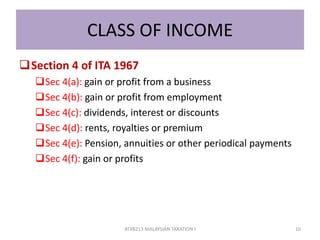

INLAND REVENUE BOARD MALAYSIA INCOME FROM LETTING OF REAL PROPERTY Public Ruling No. Rents royalities or premiums. Where the property concerned is managed and let in such a systematic or organized manner that the letting can be regarded as carrying on a business the income from the letting can be charged to tax under section 4a of the Act.

General management and administration. Rental income is filed under Section 4 d of the Income Tax Act 1967. Procurement of raw materials components and finished products.

Pensions annuities or other periodical payments not falling under any of the foregoing paragraphs. Under the laws of that territory is to be allowed as a credit against tax payable under this Act. Clue of what section 4 Income Tax Act 1967 trying to classify.

Income Tax Act 1967- Part 4 in Finance Law v the amount of his reserve fund for unexpired risks relating to any such Malaysian general certificate at the end of the immediately preceding basis period. Section 4 income tax act malaysia. Section 7 of the Act sets down 4 circumstances of which an individual can qualify as a tax resident in Malaysia for the basis year for a year of assessment.

Rent as a business source. Or Income Tax Act 1967. When rental income is assessed under section 4 d it has to be grouped into three sources namely residential properties commercial properties and vacant land.

And b subject to subsection 12 by deducting from that aggregate the amount of--. A b c d e f Business. FAQs on Section 144 of the.

Dividends interest or discounts. Any particular dealing or transactions must come within the walls of scope. Income falling under paragraph 4 f chargeable to tax 41 The introduction of a new section 109F of the ITA with effect from 01012009 provides a mechanism to collect withholding tax from a non-resident person who receives income which is derived from Malaysia in respect of gains or profits that fall under paragraph 4 f of the ITA.

42011 Date of Issue. E following classes of income are liable to income tax pursuant to Section 4 of the Income Tax Act 1967. Therefore the assessees should be extremely careful while filing returns and providing information on their total income.

Income tax under section 4d of the Act. 1 Subject to this section income tax charged for each year of assessment upon the chargeable income of a person who gives any loan to a small business shall be rebated by an amount equivalent to two per cent prorated per annum or such other rate as may be prescribed from time to time by the Minister on the outstanding balance of the loan before any set off is made under. 4 Any arrangements to which effect is given under this section may include a provision for relief from tax with respect to any person of any particular class.

This legislation on interest restriction is based on The Base Erosion and Profit Shifting BEPS Action 4 of the Organisation for Economic Cooperation and Development OECD where the aim is to prevent base erosion through the use of excessive interest expense or any payments which are economically equivalent to interest claimed by businesses. Income falling under Section 4f of the Income. Under Section 60E of the Income Tax Act 1967 income derived by an approved OHQ company is given a tax concession from the provision of qualifying services in respect of.

Section 144 of the Income Tax Act is a significant part of the income tax law. A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is issued for the purpose of providing guidance for the public and officers of the Inland. In Malaysia income tax is generally governed by Income Tax Act 1967 Act 531967.

If youre renting a property for business purposes however your rental income is filed under Section 4 a of the Act under business income.

Form Cp 58 Duty To Furnish Particulars Of Payment Made To An Agent Dealer Or Distributor Etc Malaysian Taxation 101

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Tax Incentives For Research And Development In Malaysia Acca Global

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

Malaysia Personal Income Tax Guide 2021 Ya 2020

Ppt Tutorial 1 Introduction To Income Tax Law Powerpoint Presentation Id 3473088

.jpg)

Financing And Leases Tax Treatment Acca Global

Updated Guide On Donations And Gifts Tax Deductions

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Chapter 4 Consumer Mathematics Taxation Flip Ebook Pages 1 28 Anyflip

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download